In total, 15 restaurants in the Miami area made the top 100 list in 2021. That is more than all of the restaurants in both New York (10) and California (11).

Posts

Any lingering uncertainty about the survival of retail has waned, and, today, we seem to be in one of the stronger landlord markets in recent memory. What drove this radical shift from fear and hesitation to boundless market optimism?

The scarcity of space has had an effect in Miami-Dade, where the asking leasing rates increased 12.5% to $38.98 per square foot this third quarter, from $35.54 a square foot year-over-year.

NP International obtained a $95 million construction loan for its Paseo de la Riviera mixed-use project across the street from the University of Miami in Coral Gables.

Starwood Property Mortgage, as the administrative agent for a group of lenders, assumed the $16.5 million loan originally granted last year by TotalBank and boosted it to $95 million. The borrower is 1350 S. Dixie LLC, an affiliate of NP International led by President Brent Reynolds. The general contractor is Balfour Beatty.

“Paseo de la Riviera will break ground before the end of 2017 and will take two years to complete,” Reynolds said. “Getting the construction loan is a big milestone. We’re pleased to have a great partner like Starwood.”

NP International has yet to announce a hotel brand for the project or select a leasing manager for the commercial space.

The company acquired the 2.7-acre site at 1350 S. Dixie Highway for $44 million in 2016. The 55-year-old Holiday Inn there is being demolished to make way for Paseo de la Riviera.

The project would have 240 hotel rooms, 200 apartments, 4,380 square feet of restaurants, 20,000 square feet of retail, and a parking deck.

“The hotel will have 10 stories, and the apartment building will rise six stories on top of the parking deck,” Reynolds said. “There will be separate pools for apartment residents and hotel guests. The hotel will have a conference room to serve the community, but not full banquet facilities. There really hasn’t been a new or upgraded facilities in quite some time, so to have an upgraded, modern lifestyle brand that serves not only the community and the university, but also the businesses, in the area is a win-win. There will be a paseo for pedestrians to walk between two the buildings, passing from U.S. 1 to a public park. The paseo would draw the community into the project’s open space and encourage both the apartment residents and hotel guests to go downstairs and congregate. It’s almost like an urban living room.”

Source: SFBJ

The city of Miami inched one step closer Thursday to a multimillion-dollar quid pro quo that would land it a new administrative building and parking garage, while facilitating the construction of a $465 million mixed-use project on the site of its current headquarters on the north bank of the Miami River.

With a swift vote Thursday morning, the City Commission authorized the appointment of a special estate counsel in the city’s proposed deal to lease its riverside administrative center to property developer Adler Group in exchange for the construction of a new building and parking garage elsewhere in the city.

Under the agreement, the developer would pay the city a projected $335 million over the length of a 90-year ground lease on the city’s two-acre property through rent and a cut of sales. That adds up to a present-day value of about $70 million. The deal was proposed last year by an Adler Group affiliate, Lancelot Miami River.

City employees would remain in the building at 444 SW Second Ave., which formerly belonged to Florida Power and Light, until the construction of its new headquarters in 2020.

For Adler Group, the land swap is part of a larger plan to erect a sprawling mixed-use project on the river dubbed Nexus Riverside Central. The project would be built on the city site and a neighboring 1.5 acre parcel. It would include three 36-story residential towers with 1,350 units, a 150-room hotel and 30,000 square feet of shops and restaurants.

Despite Thursday’s vote, the proposal is far from set in stone. Even if a deal is reached by commissioners, who authorized hiring the law firm without much discussion, the question would then be put on the November ballot and at the mercy of voters.

The deal appeared to be headed for the shelf before Weiss Serota Helfman Cole & Bierman, a Coral Gables law firm, was chosen from a pool of 16 candidates. Commissioners first rejected the city attorney’s choice of Shutts & Bowen, raising questions about whether there would be enough time to get a deal together and on the November ballot.

Commissioners said they were uncomfortable that Shutts & Bowen, a Miami firm, represents a plaintiff suing the city, and also that former commissioner Marc Sarnoff currently works as an attorney at the firm.

“It’s the responsibility of the special counsel to ensure that the city gets a favorable deal,” said Miami Mayor Tomás Regalado.

A review of the proposal last year noted that the city would pay up to $123 million for its new 375,000-square-foot office and 1,200-car garage, a roughly $50 million gap from what Adler will pay to lease the riverside property. Administrators say early negotiations quickly cut into the difference, although the most recent development agreement, crafted back in November, doesn’t specify where those numbers stand.

Weiss Serota will help to negotiate further. The commission in a prior resolution voted that when the city undergoes a major real estate deal, a special counsel is needed to ensure the city receives a fair deal, and Florida law states that any long-term waterfront lease requires a voter referendum.

Regalado said he was hopeful that a deal would be reached and that a motion would be put to voters in November.

“The city’s riverside administrative center, located on highly sought-after riverfront land, lacks adequate parking and poses a challenge for residents to access,” Regalado said. “It’s not client-friendly.”

If approved and favorably voted on, the new administrative headquarters would likely be built in one of three spots: near Marlins Park in Little Havana, behind Lyric Theater in Overtown or inside the seven-acre Link at Douglas complex that Adler is building at the Douglas Road Metrorail Station.

Source: Miami Herald

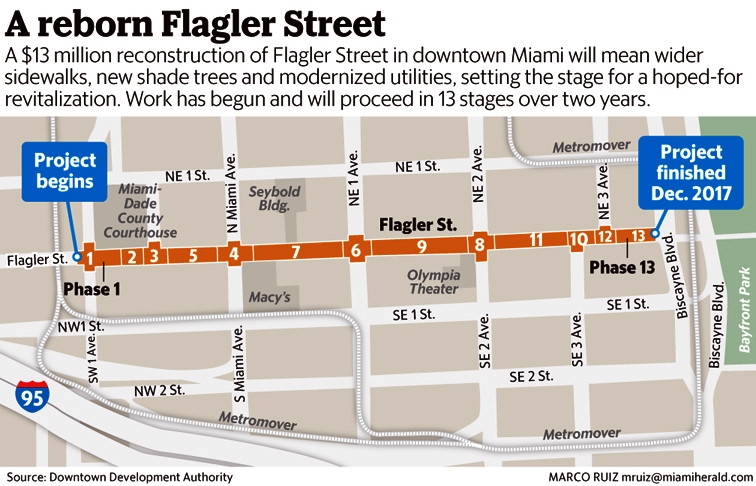

The shovels are finally hitting the pavement on Flagler in downtown Miami, nearly two years after city officials agreed to undertake a total reconstruction that’s meant to restore the tatty but storied byway to its rightful place as the city’s glittering Main Street.

Work has just begun on what’s expected to be a two-year, $13 million streetscape project, starting at the Miami-Dade County Courthouse and proceeding in 13 stages all the way to Biscayne Boulevard.

By the time the job is done, Flagler’s cracked, stained, slanted and narrow sidewalks, its scrawny-to-nonexistent greenery and its notoriously backup-prone gutters will be history, replaced by 150 shady oaks, new lighting and stormwater drains, and sidewalks twice as wide to accommodate the cafe tables and shoppers that the project’s backers expect the new street to attract.

On Thursday, the Miami City Commission approved the last bit of funding for the project, $920,000 for an upgraded drainage system and removal of old abandoned pipes that have been sitting beneath Flagler Street’s pavement for decades.

The street project’s timing seems especially fortuitous. It comes as New York entrepreneur and developer Moishe Mana has amassed what the website The Real Deal has tallied at nearly $200 million worth of properties on or abutting Flagler, with the idea of turning the street, which has long functioned as a down-market, discount-shop strip, into a restaurant, cultural and retail destination, all while preserving its historic low scale.

That combination of public improvements and private enterprise is what worked magic in places like Miami Beach’s Ocean Drive and Lincoln Road Mall, where the Flagler Street project’s backers note street and sidewalk improvements set the stage for a dramatic revitalization. That’s what they hope to replicate in downtown Miami.

“It’s really exciting,” said Brian Alonso, whose family owns the upscale La Epoca department store in the historic Walgreens building and the newer Lost Boy Dry Goods clothing shop in the also-historic DuPont building, both on Flagler. “Streetscape projects can transform an area. On Ocean, when you had Tony Goldman assembling property and the streetscape improvements at the same time, you had something transformative. You have something similar happening here. Mana can single-handedly change the area.”

Mana, who recently submitted plans for a massive, ambitious and controversial multi-use redevelopment in Wynwood, has been publicly coy about his precise plans for Flagler. But a video his company released in the fall shows refurbished buildings along Flagler, some occupied by rooftop lounges and restaurants. In the video, Mana calls Flagler Street a “Cinderella” that merely needs a new dress to reveal her beauty.

“Downtown is the future of Miami,” Mana says.

Source: Miami Herald

When Avra Jain bought the Vagabond Hotel in Miami’s MiMo district two years ago, she couldn’t capture the interest of traditional real estate investors.

Comparable rates along Biscayne Boulevard were $60 a night — or $20 an hour, she quipped. Now, after redeveloping the property into a boutique hotel with financial backing from friends and family, off-season rates stand at $159 a night, and the coming season will command $229 to $259 per night.

Changes taking place in the commercial real estate market in neighborhoods like MiMo and Wynwood are spurring widespread revitalization in Miami and creating other newly emerging areas, panelists said Friday at the Miami Association of Realtors’ RCA Super Conference, held at the Biltmore Hotel in Coral Gables.

In MiMo, Jain realized that dilapidated motels were hurting the area, so she purchased seven motels along the Biscayne Boulevard strip and shut them down. “And that is when the neighborhood started to change,” she said during a panel, “Emerging Miami: Miami River, Lemon City & Little River.”

Much more change is on the horizon. In a year, the MiMo District “will be lit up with neon and restaurants and will surprise everybody,” she told more than 100 conference attendees. Retail rents are rising rapidly, and now stand at about $50 to $70 per square foot, and $45 for second floor office space, Jain said.

Meanwhile, as Miami’s once gritty Wynwood transforms and rents there rise as well, art galleries, local businesses and creative types are being priced out, and are moving to more affordable and newly emerging — yet historic — areas like Little River and Lemon City, the panelists said. That’s where Thomas Conway’s MADE, a new co-working space for creative entrepreneurs, has recently opened. Creating a sense of place is key, the panelists said.

“We’re basically being the stewards of revitalizing these neighborhoods,” said Tony Cho, founder and CEO of Metro 1.

With investors redeveloping property, Wynwood has quickly become a thriving neighborhood, with a curated collection of new shops, restaurants, bars and breweries that attract a pedestrian crowd at all hours of the night. “It’s remarkable,” Cho said of the transformation. “It has exceeded my original expectations.”

Along with that, commercial rents are now as high as $80 per square foot on Northwest Second Avenue in Wynwood — compared to $10 per square foot 10 years ago, Cho said. In fact, Starbucks and other national retailers are starting to look into the area. That poses a challenge to retaining the neighborhood feel, the panelists said.

“People are fearful that Wynwood will turn into Lincoln Road,” Cho said.

The speed of transformation is accelerating, and with so much commercial activity in Miami, Jain said she does not worry about a downturn similar to what South Florida experienced in the last cycle.

“I don’t think Miami necessarily has to be roller coaster any more,” Jain said, citing commercial markets in Miami that are still underserved and the continuing demand for boutique hotels. “I’m starting to see it differently.”

Source: The Real Deal

The developer of Brickell City Centre has placed a larger bet on the office market, as it has converted a planned wellness usage into “Class A” office.

In 2014, law firm Akerman LLP signed a lease to occupy 80 percent of the 130,000-square-foot Brickell City Centre Green tower that was under construction as part of the $1.05 billion project in Miami. The rest of the space was supposed to be for wellness, but developer Swire Properties has made the 26,000 square feet available for office tenants. It also rebranded the tower Three Brickell City Centre. The project will include another office tower of the same size, Two Brickell City Centre.

“One of the two towers, Three Brickell City Centre, although designed with use flexibility, was originally designated as a wellness center, but current market conditions show demand for additional office space,” said Edward Owen, Swire Properties’ office leasing manager. “Swire decided that it was in the best interest of the market to create supply to further Brickell’s growth as a leading international business hub.”

Arquitectonica designed both buildings, which will have floor-to-ceiling glass and 10-foot high walls. Brickell City Centre will also feature a shopping center, restaurants, condos and a hotel. The office, condo and hotel parts of the project should be ready this winter.

According to Cushman & Wakefield’s second quarter report, the Class A office market in downtown Miami has a 13.3 percent vacancy rate and average asking rent of $41.81 per square foot. The last new office delivery was 2010.

CBRE reports that about 1 million square feet of office space is under construction in Miami-Dade County, with Brickell City Centre and All Aboard Florida’s Miami Central Station as the largest projects.

The Business Journal is tracking another 5.4 million square feet of office space that’s in the pipeline in South Florida, as described in a recent centerpiece.

Click here for a “Behind the Scenes” slideshow of the Brickell City Center

Source: SFBJ

An Argentine developer, who is not named, is planned on building a thirty story mixed-use apartment tower at 1700 Northeast 164th Street in North Miami Beach, currently a parking lot.

The site is further west than most new development in the area, which are concentrated along the Biscayne Boulevard corridor, but is a few blocks east of the old 163rd Street Mall and its Walmart Supercenter, and will be one of the tallest buildings in the area.

Source: Curbed Miami

Plans for two Miami hotel projects with hundreds of rooms between them have been submitted for review.

Norwich Dade Hotel Group LLC, a company affiliated with New Hampshire-based company Norwich Partners, submitted plans for a 20-story Marriott hotel in downtown Kendall.

The 19-page application proposes 300 hotel rooms and 155 valet-only parking spaces at 7400 S.W. 88th St. in Miami. Renderings for the hotel show signs for two Marriott brands: AC Hotels and Residence Inn. If approved, the property would be built adjacent to the Dadeland Mall. The renderings, submitted May 15 with the application, were designed by Nichols, Brosch, Wurst, Wolfe & Associates.

Grapeland Hospitality Group has proposed a Staybridge Suites near Miami International Airport with 153 rooms and possibly a restaurant and one other commercial space on the property. The Palmer Lake-area development would be located at the corner of N.W. 37th Avenue and N.W. 25th St. in Miami, which is currently vacant. The application includes 142 parking spaces and a swimming pool. The renderings were designed by Architect J. Antonio Rodriguez Tellaheche.

The Miami-Dade County Department of Regulatory and Economic Resources Development Services is currently reviewing the applications.

Source: SFBJ

About Us

Ven-American Real Estate, Inc. established in 1991, is a full service commercial and residential real estate firm offering brokerage and property management services.

Subscribe

Contact Us

Ven-American Real Estate, Inc.

2401 SW 145th Avenue, Ste 407

Miramar, FL 33027

Brokerage & Property Management Services

Phone: 305-858-1188

![[Photo via Google Earth]](http://www.ven-americanre.com/wp-content/uploads/2015/08/1700-Northeast-164th-Street-Development-150x150.jpg)