Wake up and smell the dirty money.

That’s the message federal regulators are sending to the real estate industry in Miami and other high-priced housing markets,

The U.S. Treasury Department announced it would extend and expand a temporary initiative designed to uncover criminals laundering money through real estate. The decree targets secretive shell companies — corporations that don’t have to reveal their true owners — buying luxury homes. The feds have already renewed the rules twice since announcing them in January 2016,

But this time, there’s a big difference — and it’s putting Miami’s struggling condo market under even more scrutiny.

The rules, previously so limited in scope that they applied only to a few hundred deals, will now cover every big-ticket cash transaction by shell companies in seven major markets. They are the South Florida counties of Miami-Dade, Broward, and Palm Beach; all five boroughs of New York City; San Antonio, Texas; Honolulu (included in the order for the first time); and Los Angeles, San Diego and San Francisco.

“This is going to gather much more information,” said Andrew Ittleman, a South Florida attorney who specializes in anti-money-laundering laws.

There’s been speculation about whether the administration of President Donald Trump, a former real estate developer, would double down on an initiative pushed by Obama-era officials. But the new policy shows Trump’s Treasury digging even deeper into the murky world of luxury real estate.

The end result: It’s going to get a lot harder for everyone from drug dealers to Latin American politicians to foreign royalty to shield purchases of U.S. condos and mansions from law enforcement.

The federal decree comes at a bad time for Miami real estate. Overbuilding and a slump in foreign buyers are hurting sales. The average sales price for luxury condo units in Miami Beach fell 21 percent year-over-year in the second quarter of 2017, according to a report from brokerage Douglas Elliman. Two-thirds of those sales were cash.

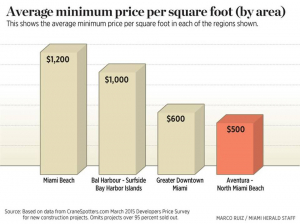

The rules kick in at different price points depending on the market. In South Florida, they apply to shell companies buying homes for $1 million or more with cash.

“This will help a market that has long neglected the amount of criminal activity taking place in the condo sector,” said Jack McCabe, a South Florida real estate analyst.

But Peter Zalewski, founder of the real estate advisory company Cranespotters, thinks the government is moving too slowly — and not going far enough.

“If you’re closing a $10 million sale and you stand to make $1 million on the deal, that’s a pretty big carrot,” Zalewski said. “And there’s no fear of a government stick, because there isn’t one in place.”

Bark Or Bite?

Critics dismissed Treasury’s original anti-money laundering rules — first deployed in Miami-Dade and Manhattan last year — as so narrow that they were practically toothless.

That’s because only less common methods of cash payments such as money orders, personal checks and hard currency had to be reported. But the latest order includes wire transfers, which are electronic exchanges of money between banks. In most home sales that don’t involve bank loans, money is sent from buyers to sellers through wire transfers. Regulators were missing out on a huge swath of transactions.

“It exempted most people from disclosure,” said Alan Lips, a partner at Miami accounting firm Gerson Preston. “In today’s world, people wire money.”

Until an act of Congress earlier this summer, the Treasury agency behind the initiative, the Financial Crimes Enforcement Network (FinCEN), did not have the authority to monitor wire transfers.

John Tobon, who leads a team of Department of Homeland Security investigators in South Florida, said the move is a crucial first step in allowing law enforcement to monitor funds moving electronically. After the first order, his agents observed home buyers immediately come up with “countermeasures” to avoid the disclosure requirements, including the use of wire transfers, Tobon said.

“Wire transfers were wide open” for abuse by criminals, “and no one was looking at them,” Toban said. “Now, we’re going to be able to identify companies and individuals that we had no idea about in the past.”

FinCEN is targeting cash home deals because it says they are most susceptible to money laundering. Cash transactions generally don’t involve heavy bank vetting. When banks give out mortgages, they are required to background their customers; professionals in the real estate industry are exempt from those responsibilities, although that could be changing.

Naughty Or Nice

As part of FinCEN’s latest push, the agency has told real estate industry professionals they should be on the lookout for suspicious activity from their clients.

“The misuse of shell companies to launder money is a systemic concern for law enforcement and regulatory agencies,” the agency wrote in an advisory to real estate agents, brokers, lawyers and other industry players.

It also encouraged them to report suspicious activity involving clients. Warning signs of bad behavior include clients willing to blindly overpay or lose money on a deal; the purchase of properties with “no regard” for their condition or location; funding that far exceeds a client’s known wealth; and clients asking for unwarranted secrecy or for records to be altered.

David Weinstein, a former federal prosecutor in South Florida who now practices white collar criminal defense, called the advisory “heavy-handed.”

“FinCEN is asking people who are not financial institutions and have no outright obligations to become an arm of the government, to become informants for them,” Weinsten said, “They’re sending a not-so-subtle message: We want you to tell us what’s going on. The implication is that if you don’t do this, we’re going to come after you and start squeezing you and say in our eyes you should have known what was going on. You should have vetted this money.”

Although real estate professionals aren’t required to set up compliance programs, no one is allowed to “willfully” turn a blind eye to money laundering, according to federal law. Weinstein recommended that realty firms consider implementing basic compliance programs.

Ron Shuffield, CEO of EWM Realty International, says the new requirement means closing agents must confirm the name and address of beneficial owners with a 25 percent stake in a corporation or limited liability company via a legal form of ID, such as a passport or driver’s license.

“There’s no legitimate buyer who’s going to feel uncomfortable with this,” Shuffield said.

The degree to which suspect money fuels Miami’s luxe real estate market is debated. But real estate crops up in case after case involving illicit funds. The release of the massive trove of offshore files known as the Panama Papers showed how easily offshore money moves into Miami real estate. The flood of cash has helped raise home prices far beyond what most locals can afford.

In FinCEN’s advisory, the agency highlighted several cases showing the threat posed by money laundering. One example cited was Venezuela’s vice president, Tareck El Aissami, and his associate, Samark López Bello. Both were sanctioned by U.S. authorities for their alleged involvement in narco-trafficking. López Bello owns three Brickell condos valued at nearly $7 million.

Tobon, of Homeland Security, said roughly 50 percent of his investigations involve money laundering through real estate.

The new order takes effect on Sept. 22 and expires on March 20, 2018. It could eventually be made permanent and expanded nationwide. The Washington, D.C., bureau of the Herald’s parent company, McClatchy, broke the news that the order would be extended Tuesday.

Achilles’ Heel

The FinCEN initiative — called a geographic targeting order — was designed to target the Achilles’ heel of American anti-money-laundering laws: weak transparency rules for limited liability corporations.

In many states, including Florida, it’s possible to set up an anonymous company and use it to buy a pricey mansion or condo. Offshore companies can be used for the same purpose. That’s catnip to criminals who don’t want anyone asking where they got the cash.

FinCEN changed the game by requiring title insurers — which are involved in almost all real estate transactions — to pierce the veil of shell companies and determine who really owns them. The information is not made public.

Because of the limitations of the original rules, roughly 240 transactions in the target markets were reported to regulators over 12 months, according to FinCEN data. But 30 percent of those sales were linked to people who’d been separately reported for suspicious activity by financial institutions.

In Miami-Dade, 16 of 32 reported deals were linked to suspicious buyers.

“They’re going to capture a lot more activity now,” said Jason Chorlins, a risk advisor at Miami accounting firm Kaufman Rossin. “The majority of this activity is done via wire transfer.”

Source: Bradenton Herald