Wealthy buyers from Brazil, Venezuela and Argentina have fueled a real-estate frenzy in Miami in recent years, sending luxury-condo prices soaring. Now, Miami developers and real-estate agents are setting their sights on a more distant part of the world: China.

In April, representatives for several Miami condo buildings made the 8,000-mile-trip to the Beijing Luxury Property Show, a trade show that attracted more than 5,200 wealthy Chinese to look at international properties. Sales agents for the Fendi Chateau Residences, a luxury development going up near Florida’s Bal Harbour, handed out brochures in Mandarin for condos priced from $5 million to $22 million. Nearby was Lauren Marks, the marketing coordinator for two luxury-condo buildings: Palazzo Del Sol and the forthcoming Palazzo Della Luna, on Miami’s Fisher Island.

“I’m here on a fact-finding mission,” said Ms. Marks. “I’m trying to decide if this is the right place for us to facilitate a meaningful relationship with Chinese buyers.”

Executives of the Miami Association of Realtors, the largest local group of the National Association of Realtors, were there, too, handing out Miami market data and gold palm-tree pins attached to a card with the tagline, written in Chinese, “Enjoy the unique taste of life.”

Part of the reason for their journey: South American buyers, who comprise the largest foreign buying group in Miami, aren’t buying as rapidly anymore. A recent study by the Miami Downtown Development Authority found that sales of new condo units still under construction have slowed, in part because South American investors have less buying power, due to the increase of the U.S. dollar compared with South American currencies.

Meanwhile, Chinese buyers are beginning to take a closer look at the city.

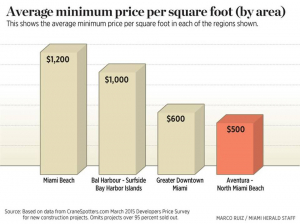

“The Chinese are coming along very strong,” said Simon Henry, co-founder of Juwai.com, a China-based website that connects wealthy Chinese with overseas properties.“Miami looks relatively cheap compared with some of the big cities like San Francisco and New York.” Juwai says the average budget for Chinese buyers shopping for overseas properties on its site is $2.3 million.

Karen Xu, a Shanghai resident, is looking at one-bedroom condos in the U.S. as an investment. She says she didn’t consider Miami until she saw a marketing table at the Juwai Agent Summit in Shanghai in May for Brickell Flatiron, a downtown Miami development where one-bedroom condos cost $500,000 to $750,000. The deputy director of a boutique investment firm, Ms. Xu, age 35, was initially interested in a Manhattan home, but said she’s priced out. “Two to three years ago, prices were OK,” she said. “Now people are saying, ‘Buy in Brooklyn.’ I don’t want Brooklyn.”

Vanessa Grout, president of CMC Real Estate, which is developing Brickell Flatiron in downtown Miami, traveled to Shanghai in May to meet with investors and real-estate agents who could help connect her to Chinese buyers. Photo Credit: Alexia Fodere for The Wall Street Journal

CMC Group, which is developing Brickell Flatiron, is marketing the property to the Chinese via local brokerages, says Vanessa Grout, CMC Real Estate president.

Currently, only 2% of international buyers in Miami come from China, according to the Miami Association of Realtors. But potential changes in Chinese investment policies, and the relatively strong Chinese yuan, are making the Chinese look like a good bet to Miami developers. The Chinese government is expected to begin raising annual limits on how much an individual can invest overseas from the current $50,000 cap—a rule often skirted.

Lauren Marks, marketing coordinator for Palazzo Del Sol and the forthcoming Palazzo Della Luna on Miami’s Fisher Island, attended the Beijing Luxury Property Show in April. She is shown here in the Palazzo Del Sol sales office. Photo Credit: Alexia Fodere for The Wall Street Journal

Lauren Marks, marketing coordinator for Palazzo Del Sol and the forthcoming Palazzo Della Luna on Miami’s Fisher Island, attended the Beijing Luxury Property Show in April.

And Chinese buyers have become an increasingly dominant force in U.S. real estate overall. According to the National Association of Realtors, Chinese buyers recently surpassed Canadians as the top foreign buyers of homes in the U.S., purchasing $28.6 billion of properties in the 12-month period ending in March.

The Miami Association of Realtors forged a partnership with Soufun Holding’s Fang.com, one of China’s largest real-estate portals, several years ago. The relationship allows association members to offer special pricing to the website, said Teresa King Kinney, CEO of the Miami association.

One of the largest booths at the Beijing Luxury Property Show belonged to OneWorld Properties, which is marketing Paramount, a condo tower in downtown Miami with more than 500 units priced from about $650,000 to more than $6 million. Peggy Fucci, CEO of OneWorld Properties, says Miami’s luxurious image and thriving art and cultural scene appeal to Chinese buyers.

Still, there are plenty of challenges for Miami brokers trying to target the Chinese market. One of the most pressing issues is the lack of a direct flight from Beijing, Shanghai or Hong Kong to Miami.

“There were no direct flights to Hawaii until last year and up until that point foreign investment was almost nonexistent,” Mr. Henry said. “Now the Chinese are the second largest buyer there.” Spokesmen for American Airlines, which has a hub in Miami, and Cathay Pacific Airways, based in Hong Kong, both said there are currently no plans for new routes from greater China to Miami.

Ms. Grout, who spent a week in Shanghai in May, said it’s difficult to figure out what appeals to Chinese buyers, because there are many contradictions and not all buyers think alike.

During the Juwai summit, Ms. Grout said a Chinese real-estate agent asked her which direction the Brickell Flatiron units face. She told him they were east facing, toward the ocean. “He walked away right after I said that, saying facing east is bad for Feng Shui,” Ms. Grout said. “I had never heard that before.” (Feng Shui consultants say a south-facing unit is most preferable, to get ample sunshine, but a window facing east, for example, could create good energy for early birds.)

A rendering of the Fendi Chateau Residences in Miami. Agents for the development handed out brochures in Mandarin at the Beijing Luxury Property Show. —Venegas International Group

Monica Venegas, principal of the Miami-based real-estate firm Venegas International Group, has been coming to China property shows for the past seven years. “People finally recognize my face here,” Ms. Venegas said during LPS in Beijing. She added that she’s learned to be patient, as Chinese buyers rarely buy on the spot, and often are swayed by the advice of their friends.

Real-estate agents estimate that bringing a sales team and setting up a booth at a mainland property show can cost anywhere from $30,000 to $150,000—making it a pricey trip if a there’s no sales outcome. Aside from travel and accommodation costs, developers also must pay for translation services and shipping materials to China ahead of the show.

A few weeks after returning from Beijing and Hong Kong, Ms. Marks, of Palazzo Del Sol, said she hadn’t heard of any sales as a direct result of Miami developers attending the Beijing expo.

“I have a hunch our marketing dollars are going to be better served in Hong Kong with more intimate gatherings of ultra-high-net-worth individuals and less red tape,” said Ms. Marks, emphasizing that her development is looking for residents, not investors. “The only way to really grasp that was to go there and experience China in person.”

Source: The Wall Street Journal