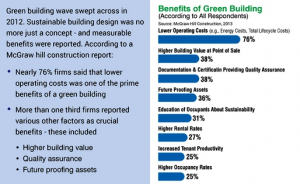

Green buildings have a number of different features that are great for the environment, but it turns out that they’re also great for the owners and landlords who rent them out.

A new study conducted at the University of Guelph shows that green office buildings have higher occupancy rates and more satisfied tenants.

Researchers reached this conclusion after analyzing ten years of data from one of North America’s largest commercial real estate firms. It examined many different kinds of variables, including monthly rents, lease renewals, energy and water consumption, and tenant satisfaction.

Higher Occupancy And Satisfaction

For nearly 300 green buildings in North America – 148 in Canada and 143 in the United States – green buildings scored better in these categories than their non-green counterparts. Buildings were only able to qualify for the study by meeting energy efficiency and sustainability standards based on LEED, BOMA BEST, and ENERGY STAR certification programs.

“This is one of the most in-depth analyses of sustainable and energy efficient building operations to date,” said Avis Devine, housing professor at Guelph.

Researchers found that occupancy rates in green buildings were higher in Canada and the United States by 18.7% and 9.5%, respectively. To some this may be surprising, considering that the average rent prices were 3.7% higher in both countries.

In Canada, tenant renewal rates were 5.6% higher for green buildings, and tenant satisfaction scores were 7% higher. Energy consumption was also much lower in green buildings. Researchers found that energy consumption per square foot was 14% lower in U.S. green buildings.

Unique And Precise

The study is a substantial due to its precise nature and the amount of data that was covered.

“Previous studies have suggested correlations between green buildings and financial outcomes but none have included such diverse metrics across a large portfolio, and covering such a substantial period of time,” said Devine.

The time reference is perhaps one of the best facets of the study that makes it unique. The 10-year period that the researchers analyzed stretched from 2004-2013, a time when North American housing markets went through boom, bust, and recovery periods.

The researchers hope that their study will allow green buildings to flourish in North American housing markets.

“Building owners and investors are affected by the choices they make on investments in energy and sustainability issues . . . This study is an important step toward mapping the business case for more sustainable building,” said Devine.

The full study has been published in the Journal of Portfolio Management.

Source: Consumer Affairs